Challenges as Opportunities: Insights into our Restructuring Projects

Industries

ARES Advisors has successfully demonstrated its expertise and long-standing experience for companies in special situations across a variety of exciting projects in different industries and functions. As a specialized consulting firm, we develop tailored and effective action strategies for our clients, ensuring a timely turnaround. If necessary, we also take on interim key roles at the C-level to effectively implement initial measures. In our independent role as appraisers, we support the entire range of stakeholders in economic decision-making.

Discover through our case studies how we, as a sparring partner for companies, jointly master critical challenges and sustainably commit to their strategic goals.

Logistics

Quick-Reporting for Faster Responsiveness

A German logistics company faced the challenge of optimizing its monthly reporting and closing the gap between planned goals and actual results in route planning. ARES Advisors was tasked with reviewing the existing processes through detailed deviation analyses and initiating improvements.

- Revenue: €40 million

- Employees: 300

- Locations: Germany

Successes

The introduced measures and subsequent implementation not only improved the transparency and efficiency of financial reporting but also led to a significant increase in EBIT by 2% to 4% through proactive actions. These improvements have allowed the company to streamline its operational processes and sustainably strengthen its market position.

- Development and implementation of a more efficient monthly reporting system

- Detailed gap analysis to identify critical deviations between plan and actual in route planning

- Digitisation of business processes

Metall Processing

Turnaround through Strategic Restructuring

A metal processing company based in North Rhine-Westphalia was in a significant economic crisis. ARES Advisors was tasked with preparing a restructuring report according to IDW S6 to create a viable basis for restructuring.

- Revenue: €70 million

- Employees: 250

- Locations: Germany

Successes

The successful implementation of the restructuring concept and the integration of new investors not only enabled a turnaround for the company but also preserved all jobs.

- Preparation of a detailed restructuring report according to IDW S6

- Intensive search and successful acquisition of suitable investors

- Strategic implementation of the restructuring concept

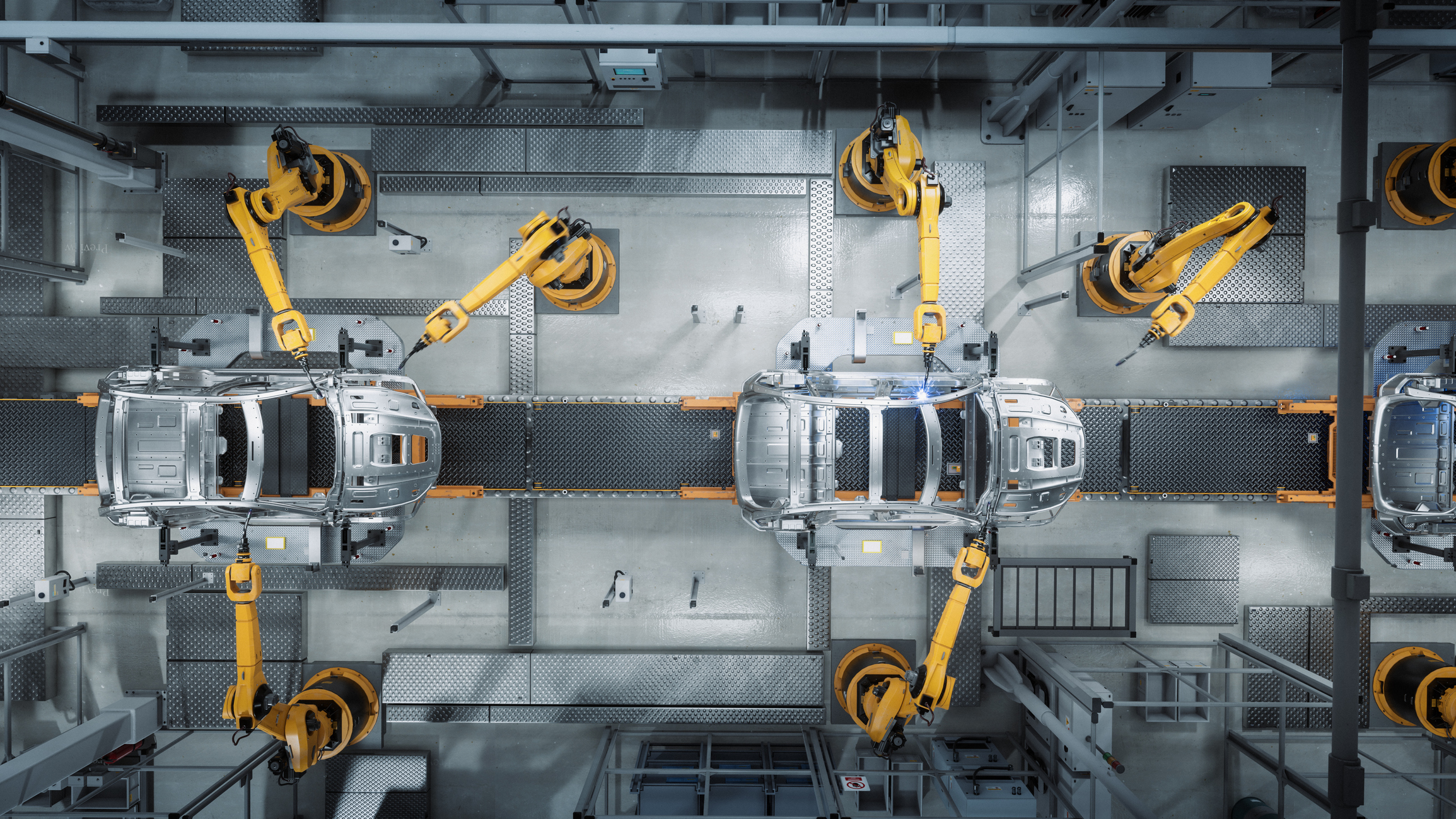

Automotive

Targeted Realignement at a European Automotive Supplier

In light of tightened market conditions, an automotive supplier engaged ARES Advisors to develop a comprehensive restructuring concept. The goal was to optimize processes from development to finished product and significantly improve cost structures.

- Revenue: €140 million

- Employees: 420

- Locations: Europe

Successes

The restructuring facilitated the involvement of a strategic investor and the realisation of sustainable cost reductions, significantly strengthening the financial stability and competitive position of the client.

- Development and implementation of a detailed restructuring concept

- Comprehensive optimisation of the process chain in development and production

- Targeted measures to minimise costs in critical business areas

Construction Supplier

Restructuring leads to a more robust Balance Sheet

To stabilise its financial position, a European construction supplier engaged ARES Advisors to restructure its liabilities through controlled self-administration under §270 InsO. After the company was able to generate operational earnings, the goal was to reduce the debt level and strengthen the balance sheet.

- Revenue: €110 million

- Employees: 370

- Locations: Europe

Successes

The restructuring measures led to a significant reduction in debt levels, paving the way for new investors to come on board.

- Comprehensive restructuring of liabilities to optimize the company's financial structure

- Support for controlled self-administration under §270 InsO to effectively manage existing liabilities

Furniture Manufacturer

Turnaround through Strategic Outsourcing and Divestitures

Faced with financial challenges and operational inefficiencies, a medium-sized furniture manufacturer engaged ARES Advisors to quickly develop a plan for a positive continuation prognosis. The goal was to optimise the existing cost structure and sustainably increase competitiveness.

- Revenue: €20 million

- Employees: 110

- Locations: Germany and Poland

Successes

The measures derived led to a significant improvement in operational efficiency and a streamlining of the company structure. These adjustments enabled the furniture manufacturer to secure its existence.

- Development and implementation of a comprehensive restructuring plan

- Outsourcing of non-core activities and divestiture of inefficient business units

Machinery and Plant Engineering

Transformation from Medium-Sized Business to Global Player Through Comprehensive M&A Support

A German machinery and plant engineering company aimed to expand its global market presence and increase its efficiency before a planned sale. ARES Advisors was tasked with realizing efficiency improvements and proactively supporting the M&A process.

- Revenue: €40 million

- Employees: 90

- Locations: Germany

Successes

Our activities not only enabled a significant increase in operational efficiency but also facilitated a merger with a strategic partner, leading to the enhancement of a competitive product portfolio. The successful international expansion allowed the company to evolve from a medium-sized business to a global player.

- Development and implementation of strategies to optimize company processes

- Strategic advice during the transaction process

Wholesale

Efficient Restructuring through Strategic Divestiture

- Revenue: €160 million

- Employees: 2500

- Locations: Europe

Successes

The measures derived enabled not only the extensive retention of employees but also the avoidance of liability claims against investors

- Strategic divestment of unprofitable business areas

- Implementation of efficient cross-border process controls to optimise operations

- Coordination and execution of the liquidation of selected subsidiaries

YOU REQUIRE OUR HELP?

Schedule an appointment for a free initial consultation, during which we will present you with initial options and discuss the further procedure either personally at your prefered location or over the phone.

Frequently Asked Questions

What is a restructuring report according to IDW S6 / BGH?

What is a continuation prognosis?

A “positive continuation prognosis” is given when the necessary financing of the company is secured with a high probability for at least 18 to 24 months.

How long does it take to prepare a restructuring report?

The restructuring report is completed. What happens next?

What is a CRO / restructuring manager?

Managing a corporate crisis requires quick action and intensive communication with a variety of stakeholders, including banks, lawyers, and auditors – all in addition to regular business operations.

YOU REQUIRE OUR HELP?

Schedule an appointment for a free initial consultation, during which we will present you with initial options and discuss the further procedure either personally at your prefered location or over the phone.