Competence

CRO/ Interim

Our clients regularly engage ARES Advisors when their company has been undergoing strategic realignment, transformation, reorganization, or a "Fit for Future" program for an extended period. Such restructuring processes are often accompanied by personnel changes in management, or there may simply be a lack of capacity to build the necessary specialist knowledge.

Especially in owner-managed companies or start-ups, the entire complex of "restructuring and turnaround" leads to exceptional demands and stresses. After all, it's not just about the existence of the company and its employees – it's about a life's work.

PROFESSIONAL SUPPORT FOR YOUR TEAM!

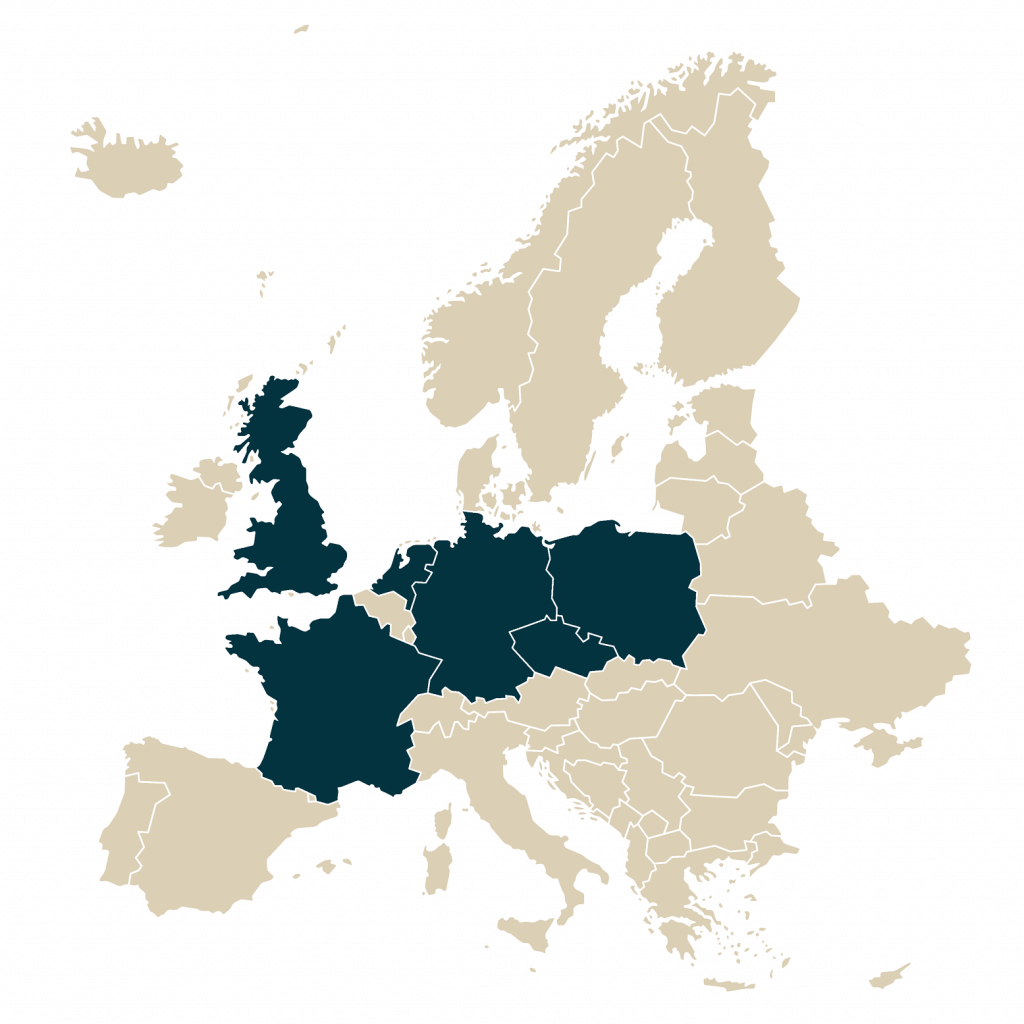

ARES Advisors not only supports you as a sparring partner for strategic approaches – we also take on operational responsibility and are proactively involved and internationally experienced in communication with lawyers, tax advisors/auditors, unions, authorities, and governments.

Frequently Asked Questions

What is a restructuring report according to IDW S6 / BGH?

When a company is in a crisis situation, the financing banks – as well as other creditors and state institutions – require the report of an independent expert. This report outlines the historical development, the causes of the crisis, and the necessary measures for a “positive continuation prognosis.” A professional restructuring report thus provides an important foundation for effective restructuring.

What is a continuation prognosis?

How long does it take to prepare a restructuring report?

The restructuring report is completed. What happens next?

What is a CRO / restructuring manager?

YOU REQUIRE OUR HELP?

Schedule an appointment for a free initial consultation, during which we will present you with initial options and discuss the further procedure either personally at your prefered location or over the phone.